.

.  .

.

The INFINITECH Project

It is a fact that Big Data, AI & IOT rise in finance and insurance. Though, there is still a set of challenges that industries must overcome to improve their overall efficiency of processes and optimization of decision making. Regulatory barriers, lack of datasets, testbeds and validated business models prevent us from realizing the full potential of these new technologies. This led the global leaders in ICT & finance to join forces. The result of this union, is the creation of the INFINITECH. The H2020 project consists of 46 partners in 16 countries across EU. The budget of it estimates in over 21 million euros.

The project will run for three years. INFINITECH constitutes 14 high impact pilots and 9 testbeds. The major force of this project lies in the diversity of the partners that form the consortium. All of them, are experts and sucessful to their field of interest and bring something to the table. This global selection made so as to create an unprecedented overall knowledge of the fintech and insurtech sector.

INFINITECH will provide:

- Novel BigData/IoT technologies for seamless management &querying of all types of data. Such kind of data are: interoperable data analytics, blockchain-based data sharing, real-time analytics. Libraries of advanced AI algorithms are taken into account, too.

- Regulatory tools that incorporate various data governance capabilities and facilitating compliance to regulations. (e.g., PSD2, 4AMLD, MIFiD II).

- Nine novel and configurable testbeds & sandboxes. Each one offers Open APIs and other resources for validating autonomous and personalized solutions. A unique collection of data assets for finance/insurance will also be available.

Our role to PILOT#12 – Real World Data for Novel Health-Insurance Products

In the era of digital disruption, we usually notice services and products that take into consideration the meritocracy for the citizens. Experts study a lot the actual usage and exposure to risks in aim to satisfy the user.

Many industries have already implemented services to satisfy better their costumers. Financial industry for example, establishes personalized financial services, banking etc. Also, in insurance industry for vehicle insurance, we spectate various products which have a base on IoT measurements. With a view to personalized services, this pilot aims to develop an accurate risk assessment tool. This tool, we believe, will recreate the products of Life Insurance Industry.

People daily produce a huge amount of unexploited but potentially, very useful data. Application create such kind of data like activity tracking data. This pilot (pilot #12) will demonstrate how Insurance companies can utilize Real-World Data to result in novel, more personalized insurance products that fit better customer needs. This approach will lead in the future to a win – win case between the insurer and the customer.

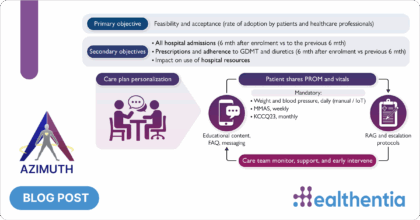

Healthentia, our e-clinical platform, services as a Real-World Data capturing infrastructure to the pilot. This infrastructure will collect a various amount of data (such as activity data, demographics etc.).

Novel machine learning and deep learning approaches will analyze these data in order to stratify the risk level of users. Processes will take place following all data privacy policies. Categorization of each user will happen according to personal habits, measurements and needs.

According to this approach, both the insurer and the customer will benefit. Insurers will have a more accurate estimation of customer risk level and will not overestimate/underestimate customer’s undertaken risk. On the other side, customers will get a stonger motivation to have better and more healthy habits while increase their life expectancy.

We expect this outcome to assist insurance market and offer new products. Products that would take into consideration the risk related to the health of the users.

Our brand new H2020 INFINITECH website is your gateway to our news, events and efforts.